Thomas Breen photo

Unique Auto's David Locklear: Prices dip, "still higher than ever."

Record-high used car prices are down. Which means New Haveners’ real estate taxes could go up this year.

That tax-for-tax tradeoff is baked into Mayor Justin Elicker’s proposed $680.3 million general fund budget for Fiscal Year 2024 – 25 (FY25), which begins on July 1.

The mayor introduced the annual fiscal document on March 1, and it now heads to the Board of Alders for three months of review and tinkering before local legislators take a final vote.

The proposed budget shows spending growing faster than revenues, and taxes rising. Part of the explanation for that lies in those car-price drops.

The story behind why one affects the other is a little wonky, and gets at the contortions of city and state government to scrounge for revenue in a municipal budget world so reliant on property taxes.

The upshot: The net taxable value of all cars in New Haven is down $40 million from last year, driven (pun intended) by a slip in prices of used cars from their pandemic peak. That value drop means less money for New Haven in the form of state car tax reimbursements and local car tax revenue itself. That reduction, per Elicker’s local budget proposal, would be made up for in part by higher real estate taxes.

Ok. Now into the weeds.

Used cars on the lot on East Street.

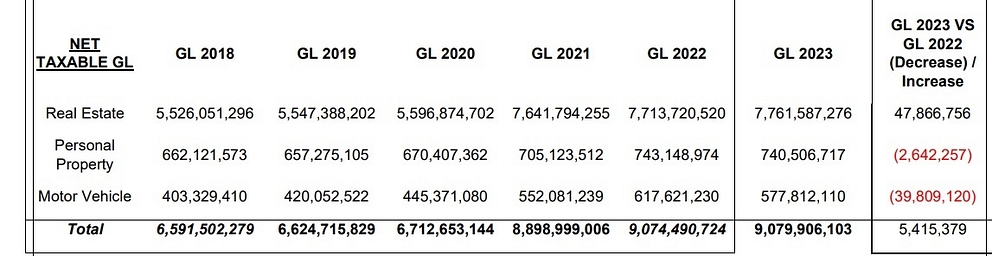

City of New Haven budget data

Changes to the city's net taxable grand list, including nearly $40M drop for motor vehicle.

Elicker’s proposed budget includes a 2.66 percent increase to city spending, from $662.7 million to $680.3 million, and a 3.98 increase to the city’s mill rate, from 37.20 to 38.68. (The mill rate translates to $1 owed in taxes for every $1,000 in assessed property value.)

So. Why would the city’s tax rate go up at a higher clip than city spending — especially given how New Haven has seen a significant influx of money from the state and Yale in recent years?

When asked that question after his budget unveiling, one of the first numbers Elicker pointed to was an expected $1.6 million drop in motor vehicle Payment in Lieu of Taxes (PILOT) revenue from the state.

The city expects to receive $4,964,253 in motor vehicle PILOT money this current fiscal year, which ends June 30. It only expects to get $3,363,148 in such funds from the state next fiscal year, which starts July 1.

The motor vehicle PILOT refers to the amount of money the state sends municipalities each year to make up for the difference between how much cities are allowed to tax car owners and how much they would like to tax them.

Fine. Good. But still. Why is the city’s pot of motor vehicle PILOT getting smaller?

Two answers: Because New Haven’s mill rate went down from FY23 to FY24, and, more importantly, because the value of used cars in particular has tripped and fallen from its pandemic-era peak — not just in New Haven, but across the state and country.

First answer first: As of 2022, the state has capped municipal car tax rates at 32.46 mills. Next fiscal year’s motor vehicle tax reimbursement from the state would then be the difference between revenue raised at 32.46 mills and revenue that would have been raised at 37.20.

As Elicker and Connecticut Conference of Municipalities Associate Director Randy Collins explained, there’s a one-year lag in which municipal mill rate is used when the state calculates any given fiscal year’s car tax reimbursement.

So, one reason for the drop in car tax reimbursements: a reduction in the city’s mill rate from 39.75 in FY23 to 37.20 in FY24. That year-old mill rate drop means less room between the city’s mill rate and the state-capped motor vehicle mill rate for the state to make up the difference with more cash.

Now for the second, and bigger, answer: New Haveners’ cars just aren’t worth what they used to be.

According to Elicker’s proposed budget, the net taxable grand list for motor vehicles in New Haven — that is, how much all of the taxable cars in the city are worth when put together — dropped from $617,621,230 in Grand List Year (GL) 2022 to $577,812,110 in GL 2023, which applies to next fiscal year’s budget.

That’s a reduction of $39.8 million in taxable car value citywide. In addition to the resulting $1.6 million drop in motor vehicle PILOT from the state, this reduction in citywide taxable car value means New Haven expects to collect $1.4 million less in local car taxes in FY24, too.

What gives?

Post-Covid Impact

Thomas Breen File Photo

City Budget Director Mike Gormany and Mayor Justin Elicker at March 1's budget unveiling.

Elicker and Collins stressed that this is a phenomenon seen around the state, and country. It derives from the crazy high car prices and supply chain shortages caused by the Covid-19 pandemic.

“During Covid, people could not purchase new cars. There were not new cars on the market,” Elicker said. So “the value of used cars jumped dramatically.”

In a separate interview, Collins agreed: “The big issue that we’re looking at is that during Covid, there was just an absolute shortage of vehicles on the market. You were seeing 10-year-old Honda Accords actually increase in value.”

Because of low interest rates and supply chain shortages, he reiterated, “there just weren’t vehicles on the lot. … When you have such a supply shortage, the cost of a used vehicle went through the roof.”

In 2023, however, that trend began to change.

According to a November 2023 report put out by the car price research agency Edmunds, the used vehicle market saw a 5.5 percent year-over-year reduction in average transaction prices.

This is a “course correction” from the pandemic-era used car price peaks, Elicker said. Collins said that a combination of higher interest rates, an opening up of relevant supply chains, and the availability of more cars on the market means the prices of those cars have dropped as of late.

“It’s much more expensive to buy vehicles” because of high interest rates, he said. “There’s not a lot of people purchase cars. The value of new cars is down. That’s going to push down the value of used cars, as well.” He said that municipal tax assessors across Connecticut anticipate a 14 percent reduction in the value of used cars statewide. (He also pointed to an upcoming change to how the state calculates car values for tax and reimbursement purposes, shifting from the National Automobile Dealer Association’s schedule of values to the manufacturer’s suggested retail price [MSRP] plus a depreciation schedule.)

So lower mill rate (at least, per the state’s motor vehicle tax reimbursement formula) and lower taxable grand list for motor vehicles in New Haven means: less car cash heading to the city.

But, Elicker stressed, the five-year trend for the city’s grand list is still way up. Despite this latest $40 million reduction, the net taxable motor vehicle grand list of $577 million in GL 2023 is still significantly higher than its $420 million counterpart from GL 2019 or $445 million in GL 2020.

Why does any of this matter for New Haven taxpayers?

“Because it’s lost revenue that could have offset a portion, albeit a small portion, of the proposed tax increase,” Elicker said about his FY25 budget. “But the flip side of that is, if you look at the trends, this is a reduction from last year, but it is not a reduction from two years ago” or further back. “This is more of a correction in the grand list value than it is a signal of a bigger picture problem.”

Collins also pointed out that, if the mayor’s higher proposed mill rate of 38.68 is approved by the Board of Alders, that would mean a higher reimbursement from the state in two fiscal years — given the one-year lag in which municipal mill rate is used in the state’s formula for motor vehicle PILOTs.

For now, though, per Elicker’s proposed budget: in part because car taxes and state car tax reimbursements are down, property taxpayers need to pay up.

“The reality is, no one enjoys paying taxes,” Elicker said, “but the money’s got to come from somewhere, and if the motor vehicle taxes go down, cities and towns need to collect [more] from real estate.” It’s “a little bit robbing from Peter to pay Paul.”

Elicker’s proposed budget, with the 38.68 mill rate, shows real estate tax revenue going up by $13.3 million year over year, or by 4.83 percent, from $276,951,393 in FY24 to $290,341,182 in FY25.

View From East Street

David Locklear, a used car salesman who works at East Street’s Unique Auto Sales, said that he’s seen firsthand the spike in used car sales during the Covid-19 pandemic — and the drop, relatively slight, in such prices over the past year.

Let’s say used car prices went up 25 percent at the height of Covid, he ballparked. If they’re now down 5 percent … that’s still 20 percent above pre-pandemic levels.

That means the Honda Accords that fly off of his shop’s East Street lot are still going for quite a bit more now than they did before Covid.

The early 2000 Audis he likes to buy and rehab on his own are still fetching quite a bit more than they used. On average, he said, the cars that Unique Auto Sales sells tend to be in the range of $15,000 to $20,000 these days — they’re newer cars, he said, but still, going for more than they used to.

“There’s definitely a drop,” he said about used car prices overall. But, he cautioned, “they’re still higher than they’ve ever been.”

Didn't 'something like this' happen before.....

I seem to recall a last minute 'tax surcharge' on motor vehicles in 2018 to make some quick last minute dough to balance the books....

Don't blame the used cars, blame the dealer!