Farnam Realty image

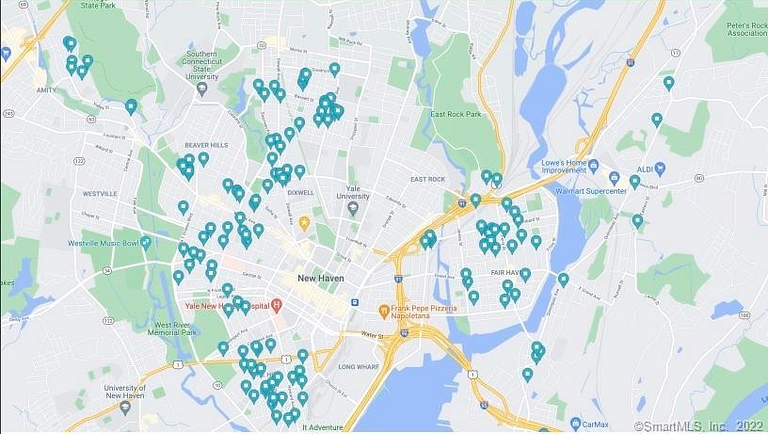

Locations of Ocean properties for sale.

Thomas Breen photo

Ocean's Aizenberg: Strategic pivot.

Anyone looking to buy 101 multi-family homes in New Haven … as part of a $52 million package deal?

Local megalandlord Ocean Management is asking that question, as it has put up for sale hundreds of local apartments in a bid to cash in on the city’s hot real estate market and transition from poverty rentals to new market-rate construction.

Local brokerage Farnam Realty Group put up those virtual “For Sale” signs this week on behalf of Ocean.

Ocean is the investor-landlord-property management company run by Shmuel Aizenberg, who first started buying up residential real estate in New Haven in 2012.

So. What’s for sale?

The so-called “Ocean 399 Portfolio,” which consists of 101 residential properties containing a total of 399 different apartments in New Haven.

Ocean is looking for $52 million — or $130,325 per unit — for the whole package.

The properties range in size from two-family homes to 10-unit apartment buildings, and — based on a map included in Farnam’s listing — they’re concentrated in the Hill, Fair Haven, West River, Edgewood, Dixwell, Beaver Hills, and Newhallville.

“This package is comprised of 399 units, a mix of 2 – 10 unit properties (101 properties) and offers an investor looking to break into the hard to reach New Haven market immediate scale,” one such listing reads. “90% of the portfolio has been renovated in the past 5 years, and offers a significant upside in rents. New Haven’s rental market has increased 10 – 20% in the last year providing a new owner immediate ability to raise rents.”

According to the portfolio’s Multiple Listing Service (MLS) submission, the gross income for these properties is over $4.59 million, the gross operating expenses are over $2.2 million, and the net income is over $2.3 million.

That’s not the only cache of rental properties that Ocean has recently put on the market.

In a separate Farnam-posted listing, Ocean is also shopping around two large apartment complexes containing a total of 137 apartments in East Haven and West Haven for a total of $19.2 million. That translates to $140,145 per unit.

“Farnam Realty group is pleased to present for sale 32 Old Foxon Road East Haven CT and 30 Coleman Street West Haven CT,” that listing reads. “This package consist of 137 Units, and gives an investor immediate scale in New Haven County. East Haven and West Haven have shown impressive rental increases over the past few years. These two assets are well positioned for a new owner to come in and push the rents 10 – 20%.”

Photos included in the Ocean 399 portfolio "for sale" listings.

Asked about why he’s put these 536 New Haven, East Haven, and West Haven apartments up for sale, Aizenberg said his company is “focusing now more on new development, new apartment builds.”

Those include a new 129-unit market-rate apartment project currently under construction at 500 Blake St. in Westville, 30 new condos and townhouse units planned for the site of the former Lehman printing factory in Goatville, and 14 recently completed new apartments at 1455 State St. in Cedar Hill.

Aizenberg said his company has additional new-apartment projects planned for Westville, Stratford, and Hartford.

Ocean will still hold a sizable chunk of New Haven real estate even after the sale of these apartments. Aizenberg said his company owns a total of around 1,400 apartments in New Haven, including the 399 currently up for sale.

What has he learned about the New Haven housing market since first entering the local market in 2012?

“I think they’re still missing a lot of apartments in New Haven,” he said. He said his company has “people calling all day, asking for apartments.”

Especially in terms of new development, Aizenberg continued, “there’s still a lot of missing inventory. We have a lot more to do.” Not only in New Haven, but Connecticut as a whole.

That’s why “I made my decision to be focusing more on new development.”

Over the past decade, Aizenberg has grown Ocean into one of the largest landlords in town. It has snapped up poverty housing in bulk and expanded with the help of tens of millions of dollars from a California-based commercial lender that has trained its money cannons on New Haven investor-landlords, particularly affiliate of Ocean and Mandy Management.

Azienberg’s company recently branched out into new housing development, with market-rate projects in the works at 500 Blake St. and the former Lehman printing factory site in East Rock.

Click here to read about the Ocean 399 portfolio “for sale” listings.

Click here to read about the East Haven-West Haven apartment listing.

"Real Estate 101"

Farnam realtor James Huffman.

Farnam Founder and CEO Carol Horsford and VP of Commercial Real Estate James Huffman shed further light on why Aizenberg is looking to sell, and why now.

“He’s looking to transition a little bit more into ground-up construction,” said Huffman, who is the lead realtor on this deal.

“[Aizenberg] acquired all these when he started” his rental housing business in New Haven a decade ago. Now the Ocean founder is “trying to scale that back [because of] the intensiveness of the management” of so many different rental properties. He’s looking instead to focus on “building new buildings.”

Horsford added that New Haven’s housing market is currently “red hot.”

“The owner of Ocean wants to capitalize on the market. We’ve brokered a lot of deals for him. And he chose to list with James Huffman, who has done a lot of really big comemercial sales and has a big reach with a lot of investors,” she said.

Farnam has also taken on some property management and maintenance responsibilities for Ocean as of late, including Ocean’s recently purchased 70-unit apartment complex at 311 Blake St., which is not included in this Ocean 399 portfolio.

Huffman estimated that the average rent in these 399 New Haven apartments is around $1,100 or $1,200 per month. He said the units are roughly 95 percent occupied. He said he does not know how many of these tenants receive Section 8 or some other state or federal housing rental subsidy. “A decent amount of them are market [rent apartments], working-class folk,” Huffman said.

Why is Ocean looking to sell all 101 New Haven rental properties as one package deal, rather than in smaller building-by-building chunks?

“It’s more valuable to an investor in a large quantity,” Huffman said. “Most people don’t come here just looking to buy one two-family or one three-family home.” Selling 101 properties individually would require 101 different closings and 101 different buyers, he said. That’s a lot.

Who might buy these properties?

“We’re hoping a large fund comes in,” Huffman said. Maybe a real estate investment trust (REIT). Maybe “one of the many local bigger investors who have significant holdings” in New Haven already. Maybe a larger out-of-town investor looking to “grab a foothold in New Haven.”

“New Haven is a desirable market,” he said. “You look across the market, there’s nothing like this.” In particular because rents at these properties are currently relatively low, and can be increased by a new owner.

Huffman said that he’s already gotten “a ton of phone calls” from potential buyers. Those have included “international investors” as well as investors from New Jersey, Boston, California, and elsewhere.

“People love the New Haven market,” he said. “The rents have been great, and seem to be increasing. It’s not every day you can purchase 399 units in one shot in a town like New Haven.”

Horsford agreed. “The Ocean portfolio, I think it’s a great scattered-site portfolio,” she said. “It’s scalable.” For an investor that wants to “get in the game,” she said, “you have to have mass.”

That is: the more properties you own in a relatively concentrated area, the easier it is to handle maintenance, collect rent, and do all of the other day-to-day tasks associated with property management and multi-family rental ownership.

She also described Aizenberg’s company’s trajectory as “Real Estate 101.”

That is, he started out buy buying some, and then many, smaller two- and three-family homes, made his money that way, and is now looking to move up into the world of larger apartment buildings and new construction.

“The management of that kind of asset class [that is, lots of two- and three-family homes] is a lot more difficult than getting bigger and bigger buildings,” she said.

Asked if this portfolio could be broken into smaller chunks, Horsford said that, “based on the ownership structure and LLCs,” these have to be sold as a package deal.

They're buying and selling homes as if they were trading cards. By offering all of them as a package deal only, individual regular people cannot just buy a single property and establish homeownership in New Haven in an already very tight market. Landlords continue to dominate real estate and make homeownership an unattainable goal for so many of us.